The investor opens a Trading account with a reputable brokerage firm (Pepperstone). The investor then funds their account in the normal way (ie. by bank transfer or visa/mastercard systems). The accounts are segregated and in the name of the client (not Lorne Capital, the brokerage (ie. Pepperstone) or the traders) so that nobody but the account holder has access to the client's funds and/or the ability to make further deposits and withdrawals.

By using a Limited Power of Attorney (LPOA), the professional traders are granted permission to trade the account on behalf of the account holder. This document is an agreement between the trader and the investor which enables the trader to trade an investor’s account on their behalf without the investor having to transfer the funds into the trader’s account. It is the ideal way to have your money traded for maximum safety, control, and true transparency. Investors can check the balance of their account at any time, see the daily trade activity, withdraw or deposit funds whenever they please. They can also revoke the LPOA agreement at anytime if they are not happy with how the traders are managing their funds. This gives them the ability to “opt out” at anytime. There is no lock in period.

Investors have live access to their managed account at all times, either through an online portal or directly through the trading platform. You can then view your account, including balance, profits, plus open and closed trades in real time via an app. However, you are not be able to place your own trades on the account, unless you revoke the LPOA, which as stated, is the document that enables the trader the ability to trade on your behalf. To our knowledge, there is no other structure available which gives clients as much control, access, flexibility and true transparency as that found in the Lorne Capital Managed Trading Account structure (except if the client were to do the trading themselves).

Why choose a Lorne Managed Trading Account?

Managed Trading Account gives you the opportunity to take part in the $5.3 trillion USD a day markets, with the added benefit of having your account professionally managed by full time, experienced traders. By removing the barriers (and costs which with traditional structures would be born by the clients) between the traders and the clients, the traders and clients both are able to make more money (as there is less fees).

The client also has full autonomy to withdraw their money whenever they like. There are no ongoing management fees or commitment periods.

Can the traders or Lorne Capital access my money?

No. Your funds are held in a fully segregated account with the National Australia Bank. This means that the only person that can make deposits or withdrawals is you.

Can I stop or make withdrawals whenever I wish?

You have 100% liquidity to your funds, so you can withdraw some or all of your money whenever you wish.

How do you access my account in order to trade?

We us Multi Account Manager software (MAM). The broker gives the trader electronic access to your account using MAM software. This access is only granted after you have authorized the LPOA (Limited Power of Attorney).

Using the MAM software, the trader now has the ability to trade multiple client accounts at the same time. When the trader executes a trade, an electronic signal is sent to your trading account and the exact same trade is executed. The same procedure takes place when a trade is closed.

MAM works by trading a percentage of an account and NOT a monetary amount. Therefore, the trader can place trades for multiple accounts with different balances. The profit or loss will represent a proportional % of each account vis a vis the traders account. As such, the "strength" of the client's trade is dependent upon their account balance.

Example:

Client #1 has a balance of $100,000USD and client #2 has a balance of $10,000USD. The trader opens and closes a trade with a 0.5% profit.

Client #1 has made $500 profit and client #2 has made $50 profit.

Can I see the trades that are placed?

Once your trading account is open you can download the trading platform to your phone, tablet and computer. You will then be able to see ALL trades as they happen in real time. A permanent record of all trades is also stored for your records. These can be accessed via the platform or by logging into your trading account online.

Can I trade myself?

Your Managed account can only be traded by our professional traders. If you would like to trade yourself then we can open an additional account for you. This account can only be traded by you. The trading company will not have access.

What are your fees?

We make money when our clients make money. We work on a performance fee basis only.

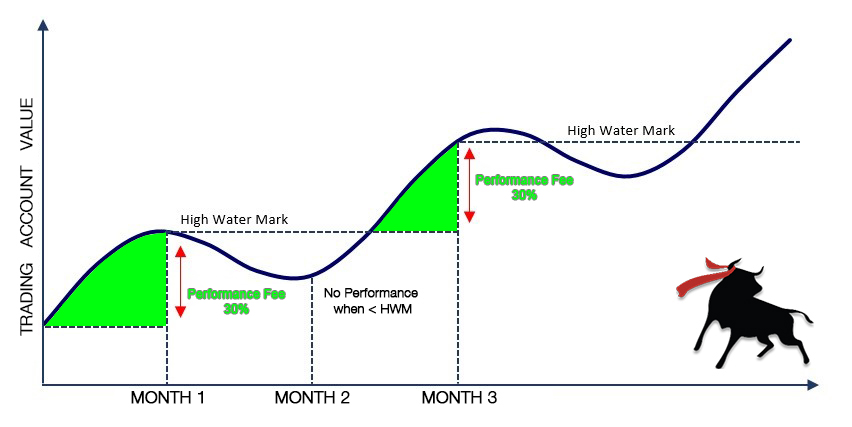

At close of business on the final trading day of each calendar month a statement is produced showing the performance of your account. Lorne Capital are paid a 30% Performance Fee from the gross profits generated on your account. It is also important to understand that Lorne Capital charges 30% from the profits that it has generated for you and not across all of your own capital.

What happens if I have a losing month?

If a losing month occurs the following will be implemented:

A. No Performance Fee will be charged

B. A High Watermark will be implemented

What is a High Watermark?

Following a losing month, our goal is to get your account back to its highest point as soon as possible. Only after that is achieved will performance fees be considered.

Who will be my broker?

The preferential partner of Lorne Capital is Pepperstone. However, it is possible to use other brokers.

Pepperstone are one of the world's leading currency brokers and are authorized and regulated in both the U.K (Financial Conduct Authority) & Australia (Australian Securities and Investment Commission).

Pepperstone are partnered with the National Australia Bank (NAB). Your funds will be held in a fully segregated account with NAB. Offering you the very highest levels of security and confidentiality. Please visit the Pepperstone website for further information - www.pepperstone.com

How do I get started?

We currently have 3x Managed Accounts. USD,EUR and GBP Managed accounts are available. Minimum investment is currently - USD$5000/EUR€5000/£4000.

Simply click the Pepperstone link below and you will be directed to the account opening page. Select "Individual" and open a Standard account. The application can be completed in a matter of minutes. Pepperstone will attempt to verify your identity electronically.

However, if you receive a "FAILED MESSAGE" please do not be alarmed. it simply means that they were unable to do so. In this instance you will be required to upload 2 x identification documents.

Please upload a color copy of your passport and a copy of your driving licence. If you do not possess a driving licence then some other form of legally recognized photographic identification.

Alternatively, you can send your 2 x ID's to support@lorne-capital.com and we will help complete the process for you. Once the application is completed and your new account is funded, please contact us using the form below and we will guide you through the rest of the process.