Currency Markets Review - 13/03/2017

With Yellen preparing to raise interest rates and the market gearing up for stronger U.S. data, the dollar extended its gains against all of the major currencies.

The only currency that did not end the week higher against was the euro and that was because of the ECB. The commodity currencies were hit particularly hard while the sterling crumbled under the weight of Brexit. The week ahead will be another busy one with four central bank rate decisions, Australia and the U.K.’s employment report and the possible trigger of Article 50 on the docket.

US DOLLAR

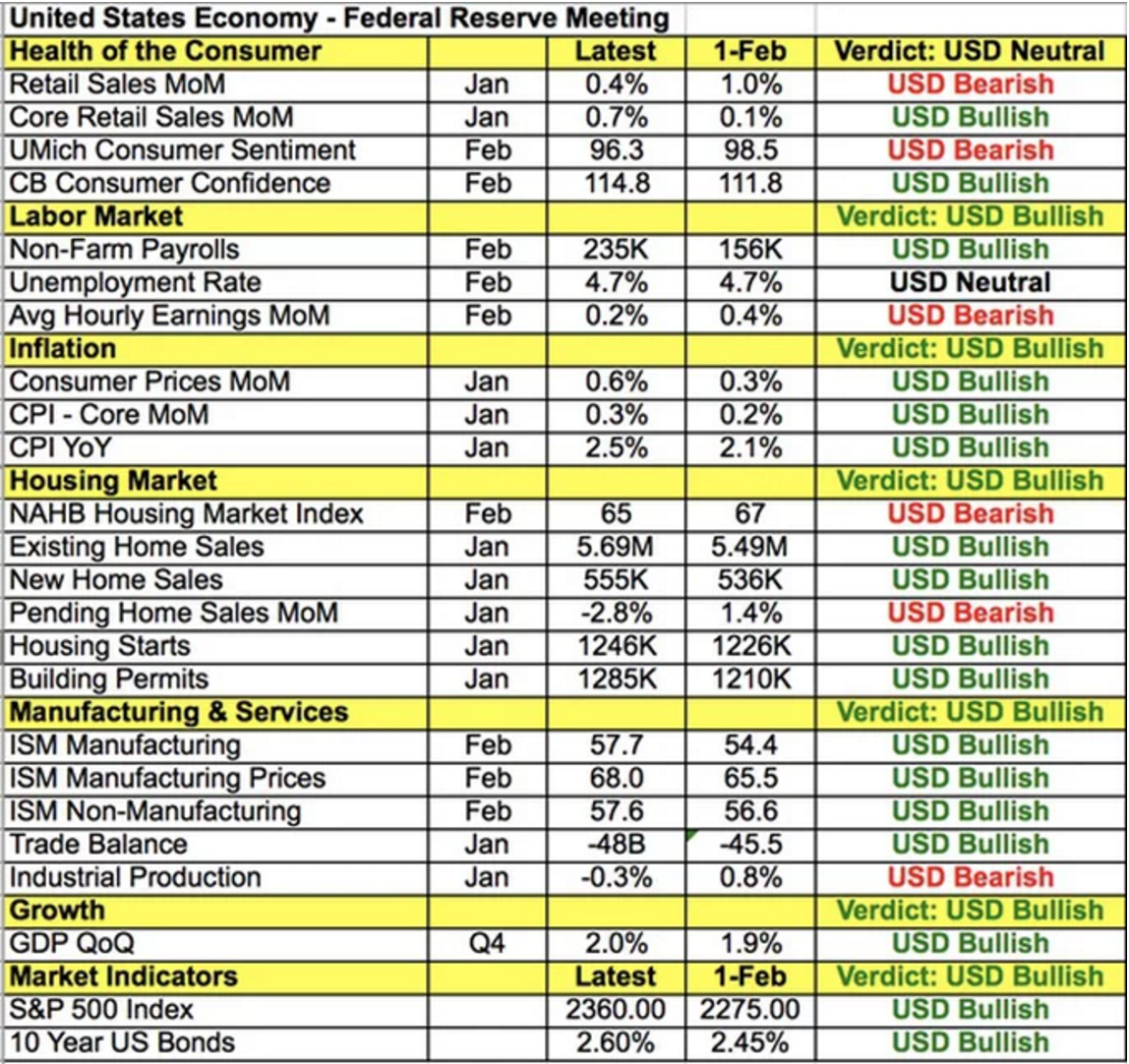

Investors took profits on their long U.S. dollar positions on the back of Friday’s non-farm payrolls report. Job growth was solid and the unemployment rate improved but average hourly earnings grew less than anticipated. With the U.S. dollar rising as much as it had ahead of the labor market report, this one minor miss was the excuse that traders were waiting for to unwind their positions. Overall, the labor data was solid with 235K jobs added in the month of February and the unemployment rate revised down to 4.7% from 4.8%. Payroll growth in January was also revised higher so while average hourly earnings growth did not accelerate as much as anticipated the 0.2% increase along with the 0.1% upgrade to January wage growth makes the overall report supportive of March tightening. Unfortunately it wasn’t good enough to extend the dollar’s gains into the weekend but we expect another leg higher in USD/JPY in the days before the FOMC rate decision. We should see 115 again and possibly even 116 if Janet Yellen suggests that the next rate hike will be sooner rather than later or June instead of September.

It is important to remember that at the end of the day, today’s non-farm payrolls report does not alter the Federal Reserve’s plans for this week’s monetary policy meeting. When Janet Yellen last spoke she made it very clear that as long as the economy progressed as expected, a March hike would be appropriate. Investors are on the same page with Fed fund futures pricing in 100% chance of a hike this week. Data has been relatively good with activity increasing in the service and manufacturing sectors, inflation on the rise, core spending growing, sentiment holding firm and housing market activity resilient despite higher mortgage rates.

Stocks also climbed to fresh record highs over the past month thanks in part to President Trump’s infrastructure and security spending plans. If the Fed doesn’t raise interest rates in March, they risk falling behind and this remains true after Friday’s non-farm payrolls report. The pullback in the greenback was nothing more than profit taking and we expect renewed strength in the dollar versus the Japanese Yen and British pound. Aside from the FOMC rate decision, consumer spending, retail sales, housing and manufacturing reports are also due for release. The Bank of Japan has a rate decision as well but unlike the Federal Reserve, no changes are expected from the BoJ.

BRITISH POUND

Meanwhile between the Bank of England’s monetary policy announcement, U.K. employment numbers and the possible trigger of Article 50 it could be an explosive week for the British pound. It is widely believed that Prime Minister May could invoke the article that formalizes their divorce from the E.U. after the House of Commons votes on the amendment guaranteeing rights for EU citizens. The House of Lords approved this amendment earlier this month and it was viewed as a big setback for May. If the House of Commons rejects the amendment on March 14th, May will most likely press forward with triggering Article 50, which formally kicks off the U.K.’s divorce proceedings with the EU. However if the House of Commons approve rather than reject the amendment, May will be faced with the far more difficult decision of overturning Parliament’s rule. Either way, when Article 50 is triggered, we expect a knee jerk sell-off in sterling as the inevitable becomes reality.

At the same time, Scotland could announce plans for a second referendum at any time. These events would overshadow the Bank of England’s monetary policy announcement easily. Since their last meeting in February, the performance of the U.K. economy has been mixed. While retail sales fell less than anticipated, average hourly earnings growth eased, consumer prices fell as manufacturing and service sector activity slowed. So between the recent deterioration in data and the prospect of slower growth post Brexit, we expect the Bank of England to remain cautious.

EURO

The euro on the other hand could outperform thanks to recent comments from European Central Bank President Mario Draghi. This past week, the ECB left monetary policy unchanged and as President Mario Draghi spoke, the EUR/USD raced above 1.06. Nodding to the improvements in growth and inflation, the central bank raised its 2017 and 2018 GDP forecast by 0.1% and boosted this year’s inflation forecast to 1.7% from 1.3%. Draghi admitted that economic risks are less pronounced and the ongoing economic expansion should be firm and broaden.

These less dovish comments from Draghi encouraged traders to take profits on their short euro positions and while dollar bulls and euro bulls will need to battle it out, the euro should outperform other currencies. Aside from the German and Eurozone ZEW survey, there are no major euro economic reports scheduled for release in the coming week which leaves EUR/USD trading on the market’s appetite for greenbacks. The Swiss National Bank has a monetary policy announcement on the calendar and while policy will be kept steady, the SNB should continue to talk down the currency.

AUD, NZD, CAD

The Canadian, Australian and New Zealand dollars were hit hard this week by softer data, lower commodity prices and a stronger U.S. dollar. We’ve officially seen the top in AUD/USD and after Friday’s exceptionally strong Canadian labor market report, USD/CAD could be near a peak as well. USD/CAD has been one of the strongest currencies this month and is due for a correction. Friday’s labor market report could be the catalyst as more than 105K full time jobs were added in the month of February, driving the unemployment rate down to 6.6%. This was the largest increase in full time work since May 2006. Although part time work plunged the change from part time to full time work is very healthy for Canada’s economy particularly as wages are on the rise with average hourly earnings increasing 1.1%. The Reserve Bank of Australia left interest rates unchanged this past week but their mildly hawkish tone was not enough for AUD to hold onto its gains. The RBA sees global demand as improving but they feel that labor market indicators have been mixed which is worrisome ahead of this week’s Australian employment report. There are no major economic reports on the calendar for Canada or New Zealand but softer data including the drop in dairy continues to keep the New Zealand dollar under pressure.

Meanwhile the New Zealand dollar was the week’s worst performing currency. Softer trade numbers contributed to the move but NZD was also hit hard by U.S. dollar strength. When 71 cents broke the currency pair fell quickly and aggressively down to 70 cents. What was interesting about the move and NZD’s underperformance was the fact that Reserve Bank of New Zealand Governor Wheeler was slightly less dovish when he spoke this past week. Rather than express his usual caution Wheeler said he sees risks around future rate moves as equally balanced. He is still worried about the strong currency and the global economy but the housing market is strong and it’s too early to say whether the moderation in prices will continue. There are no major New Zealand economic reports scheduled for release this week which means NZD should take its cue from the market’s appetite for U.S. and Australian dollars.

The Canadian dollar was also hit hard and was the second worst performer for the week versus the greenback. There was not even one day of retracement in USD/CAD which raced form a low of 1.31 to a high of 1.3437. As expected the Bank of Canada left interest rates unchanged and their cautious views kept the loonie under pressure throughout the NY trading session. The central bank felt that there was persistent slack and subdued wage growth with exports facing ongoing competitive challenges. Although inflation is on the rise, the BoC said they would look through the temporary effect of higher oil prices. This implies that they will maintain a dovish bias that leaves the door open to additional easing. These cautionary comments overshadowed the stronger GDP report. This week will be a busy one for Canada with the country’s trade balance, manufacturing PMI and employment reports scheduled for release.